The financial technology sector is evolving at a rapid pace, and 2024 is shaping up to be a pivotal year for innovation.

As the lines between traditional banking and digital solutions continue to blur, developers find themselves at the forefront of this financial revolution.

Whether you’re part of an established Fintech development company or a solo coder with big dreams, staying informed about the latest trends is crucial for success in this dynamic field.

In this post, we’ll take a closer look at the most significant fintech trends of 2024, exploring how they’re transforming the industry and why they matter to developers.

From the rise of decentralized finance to the integration of artificial intelligence in financial services, we’ll cover the technologies and concepts that are defining the future of money.

1. The Continued Rise of Decentralized Finance (DeFi)

Decentralized Finance, or DeFi, has been gaining momentum for several years, but 2024 marks a turning point in its adoption and sophistication.

This blockchain-based approach to financial services is challenging traditional banking systems by offering peer-to-peer transactions without intermediaries.

Some key developments in DeFi include:

- Enhanced security protocols to address vulnerabilities

- Improved user interfaces, making DeFi more accessible to the average consumer

- Integration with traditional finance systems, blurring the lines between centralized and decentralized services

For developers, this trend presents exciting opportunities to create new DeFi applications, improve existing protocols, and solve complex challenges related to scalability and interoperability.

2. AI and Machine Learning in Financial Services

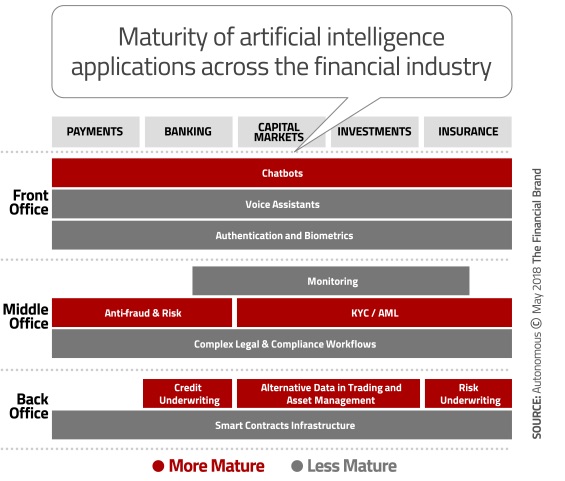

Artificial Intelligence and Machine Learning continue to revolutionize the fintech landscape in 2024. These technologies are being used across the financial services sector to enhance customer experiences, improve risk assessment, streamline operations, and boost revenues.

Some notable applications include:

- Personalized financial advice powered by AI algorithms

- Advanced fraud detection systems using machine learning

- Automated underwriting processes for loans and insurance

Developers with skills in AI and ML are in high demand as fintech companies seek to implement these technologies to gain a competitive edge.

3. The Evolution of Digital Banking

Traditional banks are facing stiff competition from digital-only challengers, and 2024 sees this trend accelerating. Neobanks and digital banking platforms are offering innovative services that cater to the needs of tech-savvy consumers.

Key features of next-gen digital banking include:

- Hyper-personalized services based on data analytics

- Seamless integration with other financial and non-financial services

- Advanced biometric authentication for enhanced security

Developers play a crucial role in creating these digital banking experiences, from building user-friendly mobile apps to developing robust backend systems that can handle millions of transactions.

4. Blockchain Beyond Cryptocurrencies

While cryptocurrencies continue to make headlines, 2024 is seeing broader applications of blockchain technology in finance.

From supply chain finance to digital identity verification, blockchain is proving its worth beyond just being the backbone of digital currencies.

Emerging blockchain applications in fintech include:

- Tokenization of real-world assets

- Smart contracts for automated financial agreements

- Cross-border payment solutions with enhanced speed and reduced costs

Developers with blockchain expertise are well-positioned to contribute to these innovative projects and shape the future of financial infrastructure.

5. Open Banking and APIs

Open banking initiatives are gaining traction worldwide, and 2024 marks a significant year for their implementation. This trend is fostering a more connected financial ecosystem where banks, fintechs, and third-party providers can securely share data and services.

Key aspects of open banking in 2024:

- Standardization of API protocols across different regions

- Emergence of new business models leveraging open banking data

- Enhanced financial inclusion through innovative services

For developers, this trend opens up possibilities to create new applications that leverage banking data and services, potentially disrupting traditional financial products.

6. Regulatory Technology (RegTech) Advancements

As the fintech sector grows, so does the need for robust regulatory compliance.

RegTech is emerging as a critical subsector of fintech, focusing on technologies that help companies navigate the complex world of financial regulations.

RegTech innovations in 2024 include:

- AI-powered compliance monitoring systems

- Automated regulatory reporting tools

- Blockchain-based solutions for transparent auditing

Developers from Azumo with an interest in both finance and regulatory frameworks have a unique opportunity to contribute to this growing field.

7. Sustainable and Green Fintech

Environmental concerns are driving innovation in the fintech sector, with a growing focus on sustainable and green financial products. This trend aligns with the increasing consumer demand for environmentally responsible services.

Green fintech initiatives in 2024 include:

- Carbon footprint tracking for financial transactions

- Investment platforms focused on sustainable projects

- Blockchain-based systems for verifying environmental claims

Developers can play a crucial role in creating these eco-friendly financial solutions, combining technical skills with a passion for sustainability.

8. Voice-Enabled Financial Services

Voice technology is making significant inroads in fintech, with voice-activated banking and financial services becoming increasingly common. In 2024, we’re seeing more sophisticated voice-based solutions that offer convenience and accessibility.

Key developments in voice-enabled fintech include:

- Voice-activated payments and fund transfers

- AI-powered voice assistants for financial advice

- Enhanced security measures for voice authentication

Developers skilled in natural language processing and voice user interface design are well-positioned to contribute to this growing trend.

9. Quantum Computing in Finance

While still in its early stages, quantum computing is beginning to show promise in solving complex financial problems.

In 2024, we’re seeing increased investment and research in this field, with potential applications in risk management, portfolio optimization, and cryptography.

For developers, this represents a cutting-edge area of fintech that combines advanced mathematics, physics, and computer science.

While practical applications are still limited, staying informed about quantum computing developments is crucial for forward-thinking fintech professionals.

Conclusion

The fintech landscape of 2024 is full of innovative technologies and bold ideas. From the ongoing growth of decentralized finance to the rise of quantum computing in financial services, developers have many opportunities to make a significant impact on the industry.

Whether you’re passionate about blockchain, AI, or sustainable finance, there’s a place for you in the exciting world of fintech. The key is to remain curious, adaptable, and ready to embrace the challenges and opportunities that lie ahead.

Frequently Asked Questions

1. How is edge computing impacting fintech in 2024?

Edge computing is improving real-time processing capabilities in fintech, enabling faster transactions and improved security for mobile banking applications. It’s particularly useful for IoT-based financial services and reducing latency in high-frequency trading systems.

2. What role does gamification play in fintech applications in 2024?

Gamification is frequently used to enhance user engagement in fintech apps, particularly in personal finance management and investing platforms. It’s helping to educate users about complex financial concepts and encouraging positive financial behaviors through rewards and challenges.

3. How are biometrics evolving in fintech?

Advanced biometric technologies like behavioral biometrics and vein pattern recognition are gaining traction in 2024. These methods offer enhanced security for financial transactions and are beingintegrated into both mobile and in-person banking experiences.

4. How are fintech companies addressing financial inclusion in 2024?

Fintech firms are leveraging technologies like blockchain and AI to create innovative solutions for underbanked populations. It includes developing alternative credit scoring models, creating micro-lending platforms, and offering low-cost mobile banking services in developing regions.

Featured image credit: rawpixel via Freepik

Sponsored post

Content credit: Andy Redan